Integration Overview

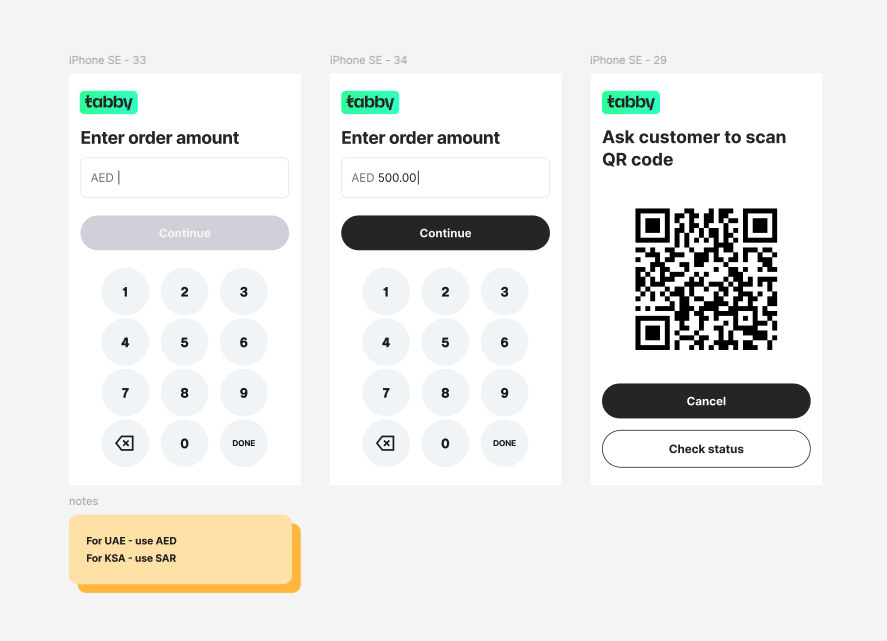

This integration allows customers to pay using Tabby by scanning a QR code displayed on the POS terminal. The flow involves:- Creating a payment session

- Displaying QR code on POS screen

- Customer scans QR code and completes payment

- Merchant receives payment confirmation

Quick Reference

| API Endpoint | Purpose | Method |

|---|---|---|

/api/v2/checkout | Create session and payment | POST |

/api/v2/payments/{payment.id} | Retrieve payment status | GET |

/api/v2/checkout/{id of session}/cancel | Cancel session | POST |

| Key Status Codes | Description |

|---|---|

CREATED | Payment initiated, waiting for completion |

AUTHORIZED | Payment approved, not yet captured |

CLOSED with “captures” object | Payment approved and captured successfully |

REJECTED | Payment declined |

EXPIRED | Session/payment expired or cancelled |

Steps to Integrate Tabby with your POS

Integration Flow

Create Session and Payment Using Checkout API

Call the Create a session API. The required payload parameters for the POS session:Eligibility Check

As a response you receive one of the two session statuses -“created” or “rejected”:

- if the session status is

“created”- save the id of the session (will be required for cancellation step) and payment.id (will be required for payment status check and refund steps) received in the response:

- if the session status is

“rejected”- show the Payment failure screen and offer the customer an alternative payment method. Please, do not proceed with any further steps with Tabby. The rejection might be related to order amount being too high, disabled branch code, or other reasons. The response payload will contain the following:

Show QR Code

When the session has status“created” you will receive the QR Code link and web_url link in the response. Use any of the links to generate and show the QR Code on the POS screen to the customer to scan.

Payment Processing

Once QR Code is shown, check the payment status using the Retrieve Payment API call. We recommend calling the Retrieve API every 5 seconds until a terminal status is received. Alternatively, you can add a “Check status” button on the POS terminal to manually check this. The following statuses can be received:CREATED- the payment has not been completed yet, wait for it to change to one of the terminal statuses.AUTHORIZEDorCLOSED- the payment is successful, mark order as successful, print a receipt.REJECTEDorEXPIRED- the payment is not successful. Ask the customer to pay with a different payment method.

Cancel a Payment

A request to cancel a payment is available in the Postman collection. You can cancel a payment in two cases:- The cashier presses the “Cancel” button on the POS.

- Automatically, after a timeout. The recommended period is 300 seconds, but the timeout should never be less than 180 seconds.

CREATED. Once canceled - the status will change to EXPIRED.

If the payment has already been successful, attempting to cancel it will return the following error: 400 Bad Request

AUTHORIZED or CLOSED. Then show a success screen, print a receipt and proceed with the order.

The Cancel API does not refund payments and can only be used to expire not finalised sessions. Once the payment receives one of the terminal statuses -

AUTHORIZED, CLOSED, REJECTED or EXPIRED - the session cannot be cancelled.Refund a Payment

You can process a Full or Partial Refund. Call Refund API for a specific payment.id with the desired amount. You can find thepayment.id by matched payment.order.reference_id in your OMS.

You can also process a refund from the Tabby Merchant Dashboard.

Only payment in status

On Merchant Dashboard such payment will have status

CLOSED with a captured amount present in the “captures”:[] array of objects can be refunded.On Merchant Dashboard such payment will have status

CAPTURED.Print a Receipt

Show a success screen and print a receipt. The receipt data can be used to identify the order and payment, and (optionally) initiate a refund if your POS system provides this functionality.| Receipt data template |

|---|

| Merchant Order / Transaction ID |

| Date and Time |

| Tabby logo |

| Tabby Payment ID (optional) |

| Merchant name (optional) |

Recommended Designs

Testing Scenarios

Kindly verify that your integration can handle all listed below scenarios.1. Payment Success

Testing Steps:- Choose Tabby on the POS terminal and enter the payment amount, press Enter.

- Show the QR code on the POS terminal for the customer to scan.

- On Tabby Checkout Page enter credentials:

- Complete the payment using

OTP:8888on Tabby Checkout page. - Verify that the successful status is received.

- Session creation response has status

“created”, and a QR code is shown successfully on the POS screen. - Tabby Checkout Page opens from the QR code.

- Credentials are entered.

- The success Tabby screen appears.

- Payment is successful and captured:

- on Merchant Dashboard payment status is

CAPTURED - via a Retrieve Payment API call response Payment status is

CLOSED, captured amount is present in the“captures”:[]array of objects.

- on Merchant Dashboard payment status is

2. Eligibility Check Reject

Testing Steps:- Choose Tabby on the POS terminal and enter the payment amount 30000.

- Attempt to create session and payment with Tabby.

- Tabby is present among payment methods on POS terminal.

- Session creation response has status

“rejected”. Tabby payment method is not available. Another payment method should be selected on POS terminal.

3. Payment Cancellation

Testing Steps:- Choose Tabby on the POS terminal and enter the payment amount.

- Show the QR code on the POS terminal for the customer to scan.

- Click cancel (Cross icon) on Tabby Checkout page (you may also cancel the session from your POS terminal).

- Tabby is present among payment methods on POS terminal.

- Session creation response has status

“created”, and a QR code is shown successfully on the POS screen. - Tabby Checkout Page opens, a session is cancelled. On checking Payment Status via Retrieve Payment API call it should be

EXPIREDstatus. A new session can be created from POS terminal.

By default, Tabby session expires after 20 minutes since creation and customer is not able to continue the session. This session expiry timeout can be reduced by the request from the Merchant side to your assigned business manager in the Integrations thread.

4. Payment Failure

Testing Steps:- Choose Tabby on the POS terminal and enter the payment amount.

- Show the QR code on the POS terminal for the customer to scan.

- On Tabby Checkout Page enter credentials:

- Finish the payment using

OTP:8888on Tabby Checkout page. - Verify the payment status via Retrieve Payment API.

- Tabby is present among payment methods on POS terminal.

- Session creation response has status

“created”, and a QR code is shown successfully on the POS screen. - Tabby Checkout Page opens, credentials are entered.

- The rejection screen with the message ‘We can’t approve this purchase’ appears.

- On checking Payment Status via Retrieve Payment API call it should be

REJECTED.

Postman Collection

- Download the JSON file.

- Import the JSON file from the downloaded archive into Postman.

- Enter your Tabby

Secret API Keyandmerchant_codeinto the appropriate Collection Variables.

POS API Collection

This API collection is used for both POS Integration and Custom Payment Links integration and includes all the POS steps.